As 2024 opens with a host of challenges and opportunities, the Italian real estate market finds itself navigating complex waters, influenced by global and local economic variables. After a period of substantial growth, the sector is showing signs of slowing down, in part due toeconomic uncertainty andrising interest rates, which have made access to credit more costly for households. Despite this, some cities, such as Milan, continue to shine with resilience, attracting investors and buyers with the promise of long-term value.

This year also leads us to reflect on the regional dynamics that shape the real estate landscape, with significant variations among cities in terms of prices and demand. After examining

how 2023 went for the real estate sector.

, we will explore key trends, mortgage challenges, and future expectations for the Italian real estate market in 2024, offering an in-depth look at what to expect in the coming months.

The role of mortgages in the housing market 2024

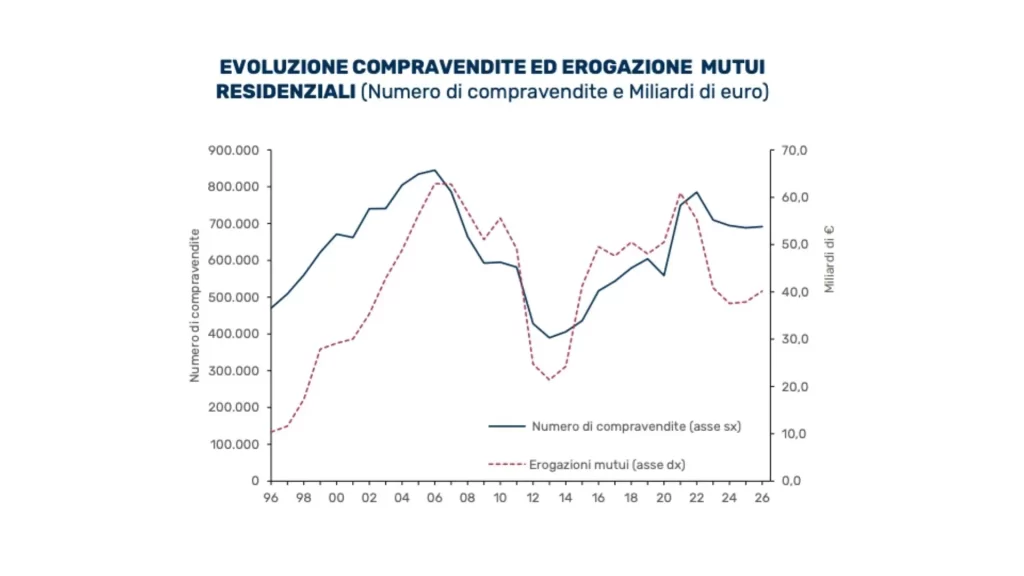

The year 2024 saw the Italian housing market facing significant challenges related tomortgage affordability, an issue that feeds directly into the performance of residential buying and selling. Rising interest rates, a phenomenon that has spanned the globe, have left an indelible imprint on the sector, profoundly affecting households’ ability to access financing. This trend has resulted in a tangible decline in real estate transactions, reflecting the close correlation between financing conditions and market vitality.

Banks’ response to the tightening of monetary policies, with a significant increase in the rates charged on new mortgages, has made the dream of owning a home particularly onerous for many Italians. The impact of this dynamic has manifested itself in a decline in real estate sales, a clear sign of the difficulties faced by would-be buyers in the current economic environment.

Toward the end of 2023, however, there was a slight decrease in mortgage rates (read Idee & Immobili’s in-depth look at mortgage trends) offering a glimmer of hope for a turnaround. This slight easing of credit conditions has stimulated cautious optimism in the industry, fueling expectations of a potential revival of the housing market in 2024. Although the road to full recovery remains uncertain and fraught with challenges, indicators for late 2023 suggest the possibility of a slightly more favorable environment for buyers, potentially catalyzing an increase in buying and selling activity in the new year.

Regional and urban dynamics

In the Italian real estate market landscape of 2024, regional and urban dynamics emerge with distinctive traits, revealing a complex fabric of trends and preferences. At the center of this scenario is Milan, a city that continues to emerge as the epicenter of real estate dynamism. Despite the general challenges the sector is facing, Milan stands out for the continuous increase in housing prices, a phenomenon that testifies to the unstoppable attractiveness of the metropolis for both investors and residents. Robust demand and a growing supply underscore Milan’s role as a barometer of the luxury real estate market and beyond, reflecting the aspiration for a high standard of urban living.

Beyond the vibrant reality in Milan, the regional comparison paints a varied picture. Cities such as Florence, Bologna and Venice follow Milan’s trend with high prices, but each has its own peculiarities that influence its market. In contrast, in other areas of Italy, such as Catanzaro and Campobasso, housing prices remain more affordable, offering different opportunities for buyers and investors. This dichotomy between attractive urban centers and more economically contained realities highlights the challenges and opportunities of the national real estate market, highlighting how geography plays a crucial role in defining the dynamics of buying and selling.

The landscape becomes even more complicated when considering factors such as quality of life, availability of services and connectivity, which help define the attractiveness of certain areas beyond mere cost per square meter.

Housing trends and consumer preferences

In the beating heart of the 2024 housing market, housing trends and consumer preferences emerge clearly, deeply reflecting the values and expectations of Italian households. One of the most incisive observations concerns the size of dwellings: the desire for spaces that balance comfort and functionality translates into a marked preference for moderately sized properties. Homes ranging from 50 to 85 square meters have emerged as the predominant choice, representing not only an efficient housing solution but also a sustainable financial compromise for many.

At the same time, the conception of the “first home” takes center stage in the real estate investment landscape, testifying to a particularly thoughtful and reflective approach toward real estate purchase. This trend is not just a matter of housing need; it reflects a prudential view of real estate investment, where long-term stability and security take precedence over speculation and quick gains. The majority of purchases geared toward “first home” signal a clear inclination toward creating a stable hearth, in an environment where economic uncertainty and market fluctuations invite more caution.

Prospects and expectations for the future

As 2024 unravels, a cautious optimism is beginning to take hold among potential buyers in the Italian real estate market. This renewed confidence does not stem from unfounded hopes, but is fueled by concrete expectations of improvements on the credit front, notably a slight but significant decrease in mortgage interest rates observed toward the end of 2023. This phenomenon has begun to instill hope in consumers that access to credit may become less burdensome, making the purchase of a home an attainable ambition again for many.

Looking ahead, the outlook for the housing market remains a complex mosaic of challenges and opportunities. The possibility of further mortgage interest rate easing represents a bright spot on the horizon, potentially spurring a pickup in buying and selling activity. However, the trajectory of the market will be influenced by a variety of factors, including global economic developments, local housing policies and demographic trends.

In this evolving scenario, market stakeholders-from investors and developers to buyers and sellers-are called upon to navigate with caution, armed with accurate information and a forward-looking vision. Resilience and adaptability will become key assets in an environment where the only certain element seems to be change itself.